Using contests to design emission tax mechanisms

Article -

Osório, A., Zhang, M. (2022): "Using contests to design emission tax mechanisms", Sustainable Production and Consumption

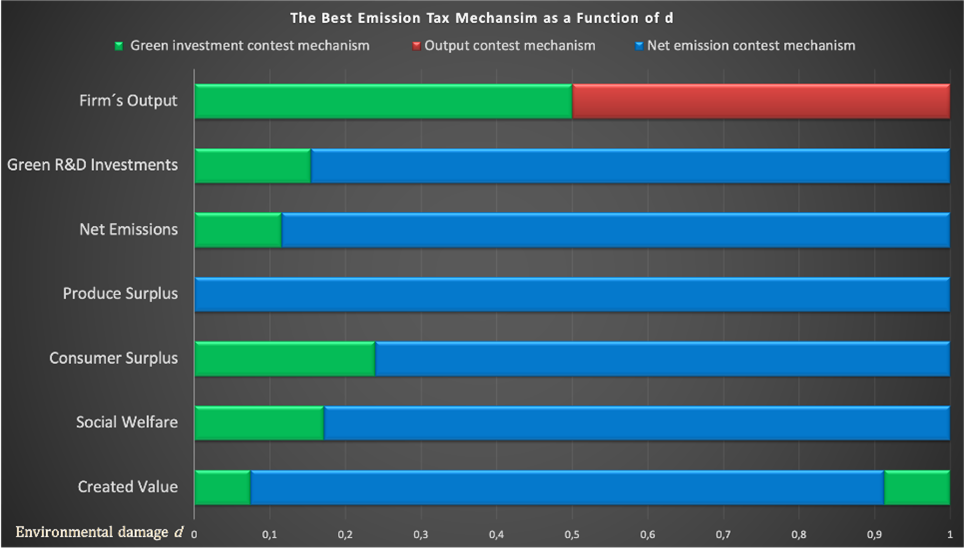

Emissions taxation is usually exogenous defined by governments. In this paper, instead, the authors consider the possibility that firms compete through a contest to pay as less taxes as possible either (or both) in terms of emitting less emissions or in terms of green R&D investments. In the first mechanism, the output contest mechanism, the taxation contest is based on the firms' emission output, in which firms pay proportionally less emission taxes when they produce fewer emissions relative to competitors. In the second mechanism, the green R&D investment contest mechanism, the taxation contest is based on the firms' green R&D investments, in which firms pay proportionally less emission taxes as they commit to greener R&D investments relative to competitors. In the third mechanism, the net emission contest mechanism, the taxation contest is based on the firms' net emission, in which firms pay proportionally less emission taxes as less pollution they generate and greener R&D investments they execute relative to competitors. The results show the net emission contest mechanism is the best to achieve carbon neutrality, maximize green R&D investments and minimize emissions in situations or industries in which the environmental damages are moderate to relatively large. However, in situations or industries in which the environmental damages are relatively small, the green R&D investment contest mechanism could be the best.

These emission tax mechanisms merge industrial organization and contests theory and opens new avenues and ways of thinking in terms of environmental taxation and policy.

Figure: The best emission tax mechanism for different indicators and varying environmental damages