Data vs. information: Using clustering techniques to enhance stock returns forecasting

Article -

Vásquez Sáenz, J., Quiroga, F.M., & Bariviera, A.F. (2023): "Data vs. information: Using clustering techniques to enhance stock returns forecasting", International Review of Financial Analysis

This study has shown that clustering models can help investors and traders predict stock prices and increase the returns of their trading algorithms.

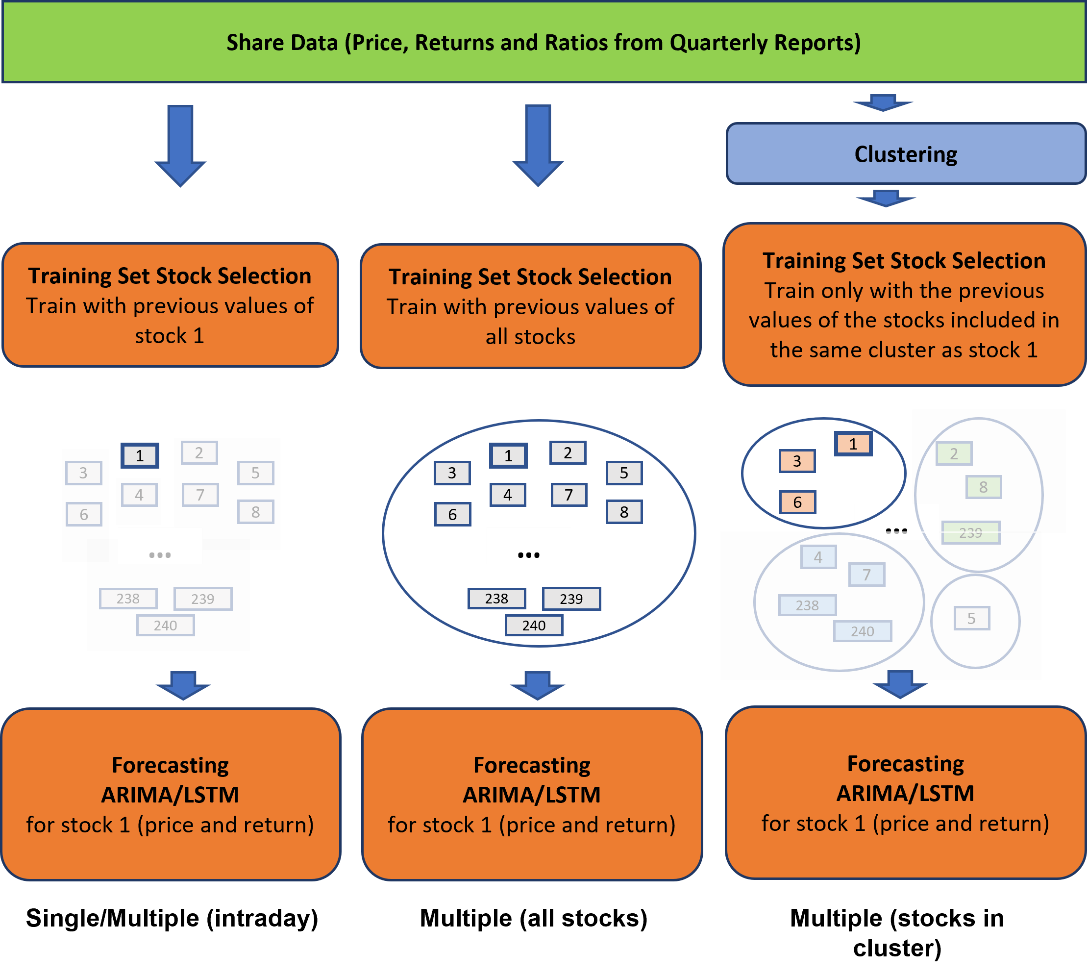

We used a method called k-means clustering (with alternative distance metrics) to group stocks based on their quarterly financial ratios, prices, and daily returns.

They then trained forecasting models for each cluster using two different algorithms, ARIMA and LSTM, to predict the daily stock price. The study found that LSTM models outperformed both ARIMA and benchmark models, providing positive investment returns in several scenarios.

Using clustering methods improved the forecasting accuracy by selecting relevant data during the preprocessing stage. Interestingly, using information from the entire sample of stocks decreased the forecasting ability of LSTM models. These findings suggest that clustering models can be a valuable tool for investors and traders in predicting stock prices and improving their returns.